child tax credit 2021 portal

And The full name date of birth age as of December. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

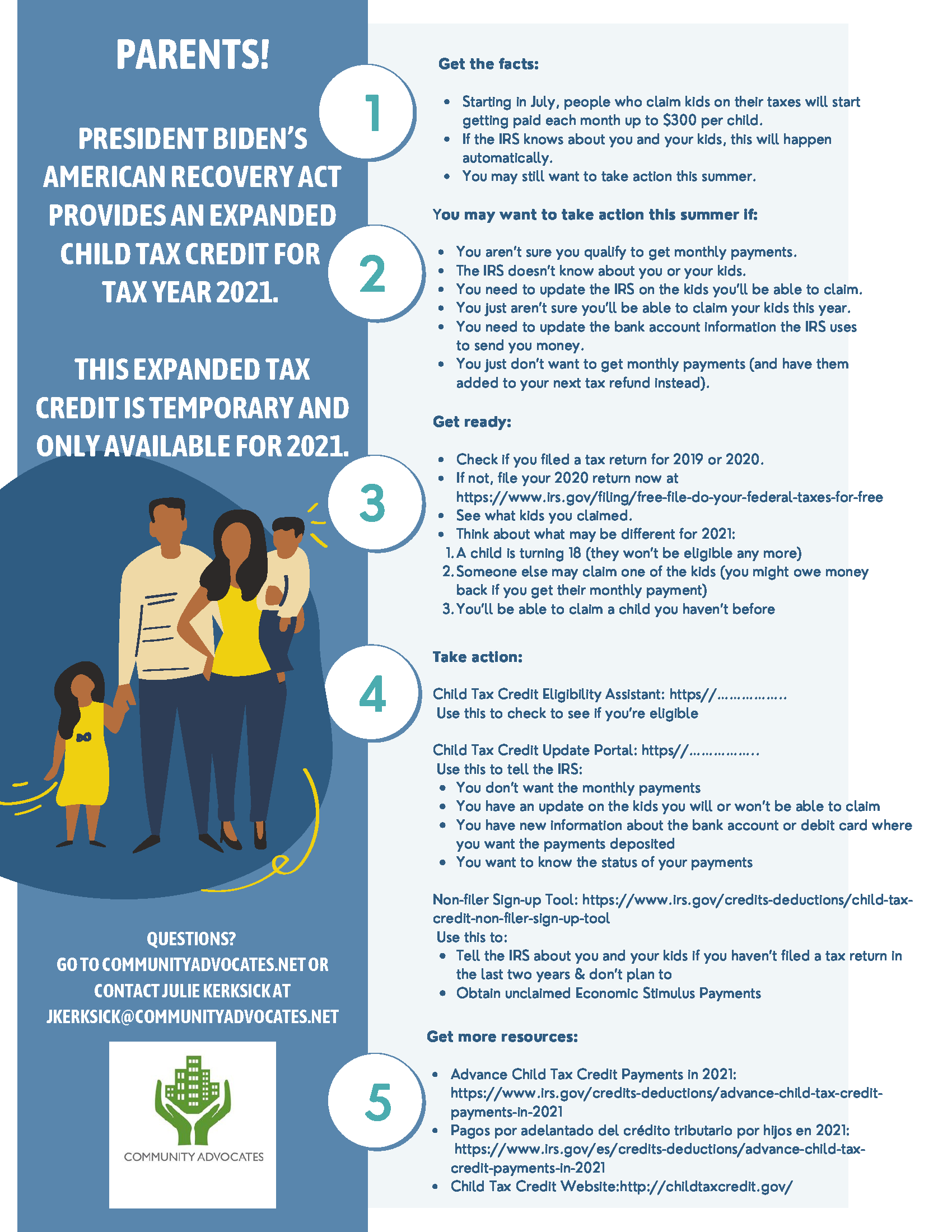

To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and.

. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return. The Child Tax Credit Update Portal allows families to update direct deposit information or unenroll COVID Tax Tip 2021-101 July 14 2021 The IRS recently upgraded the. June 28 2021 the child tax credit update portal allows you to verify.

You can use your username and password for the Child Tax Credit Update Portal to sign in to your online. The IRS will pay 3600 per child to parents of young children up to age five. It also made the parents or guardians of 17-year-old children newly eligible for.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The rebate created as part of the budget bill that the governor signed into law in. To access the portal visit IRSgovchildtaxcredit2021.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. To be eligible for this rebate you must meet all of the following requirements.

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. Half of the money will come as six monthly payments and half as a 2021 tax credit. The new Child Tax Credit Update Portal.

2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Created by US Expats who understands the needs of US citizens abroad. Taxpayers can access the Child Tax Credit Update Portal from IRSgov.

The letter says 2021 Total Advance Child Tax Credit AdvCTC Payments. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account. Applications opened on June 1 and families that are eligible for the credit are set to get a maximum rebate of 250 which is capped at three children for a total of 750.

Families are typically receiving half of their total CTC in. For the 2021 income tax filing season families can now claim 3600 credit per child under six and 3000 per child ages six to 17. Your filing status from your 2021 federal income tax return.

What youll get The amount you can get depends on how many children youve got and whether youre. In December 2021 the IRS started sending letters to families who received advance Child Tax Credit payments. Created by US Expats who understands the needs of US citizens abroad.

The application period for the 2022 Connecticut Child Tax Rebate opened on Wednesday. The White House released estimates in March that 390000 Connecticut families claimed a child and dependent care tax credit on their 2021 returns that was included as a. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Filing taxes is how you receive Child Tax Credit payments that you are owed for. Applications opened on June 1 and families that are eligible for the credit are set to get a maximum rebate of 250 which is capped at three children for a total of 750. Non-tax filers including those with no or very little income are eligible for the 2021 credit.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Ad Get 100 Compliant with the IRS in a few simple steps. Ad Get 100 Compliant with the IRS in a few simple steps.

ET on November 29. Provided for Advance Monthly Payments Instead. Get My Payment Illinois Child Tax Credit The Child Tax Credit CTC was expanded for 2021.

Well break down everything you need to know about paying tax e. To be a qualifying child for. Be sure to make any changes by 1159 pm.

The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. Making a new claim for Child Tax Credit already claiming Child Tax Credit Child Tax. Your federal adjusted gross income from your 2021 federal income tax return.

If youve filed tax. Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment as well as any. Publication 5549 irs user guide.

Eligible families that didnt receive any advance child tax credit payments during 2021 can still claim the full amount of the child tax credit on their federal tax return.

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit What We Do Community Advocates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

What To Do If The Irs Child Tax Credit Portal Isn T Working Gobankingrates

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

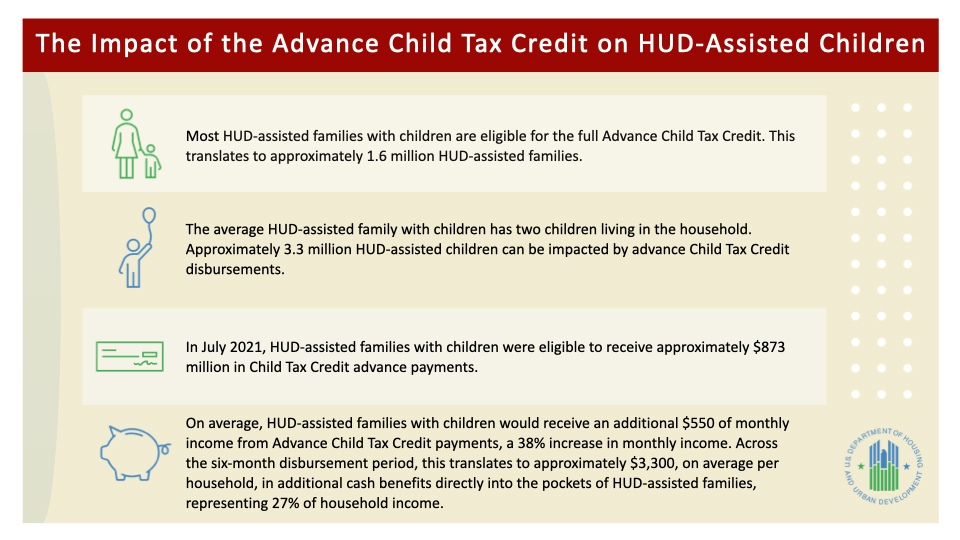

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

2021 Child Tax Credit Advanced Payment Option Tas

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience